montana sales tax rate 2020

Of Income 139 100. Sales tax region name.

How High Are Cell Phone Taxes In Your State Tax Foundation

Montana has a 0 statewide sales tax rate and does not allow local governments to collect sales taxes.

. There is no state sales tax in Montana. There is 0 additional tax districts that applies to. The County sales tax rate is.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. 368 rows Average Sales Tax With Local. Tax rate of 4 on taxable income between 8901 and 12000.

We include these in their state sales tax. Total Tax Burden by Income Level The estimated burden on a family of three of all personal taxesincome property general sales and auto taxesis provided in the tables below for three different income levels. Missoula MT Sales Tax Rate.

This is the total of state county and city sales tax rates. Montana tax rate is unchanged from last year however the income tax brackets. The state sales tax rate in Montana is 0 but you can.

The credit is equal to 2 of all net capital gains listed on your Montana income tax return. California 1 Utah 125 and Virginia 1. The Montana MT state sales tax rate is currently 0.

Lodging Facility Sales and Use Tax. The state sales tax rate in Montana is 0 but you can customize this table as needed to reflect your applicable local sales tax rate. Nursing Facility Utilization Fee NFBT Opioid Sellers License.

Montana taxes are below national averages at all income levels. Goods and services can be purchased sales-tax-free though sin taxes on alcohol and cigarettes do apply. Saltese Montana Sales Tax Rate 2022 NA.

Montana has no state sales tax and allows. The minimum combined 2022 sales tax rate for Missoula Montana is. Tax rate of 675 on taxable income over 19800.

Taxing Jurisdiction Rate. Shepherd Montana Sales Tax Rate 2022 NA. The state sales tax rate in Montana is 0 but you can customize this table as needed to reflect your applicable local sales tax rate.

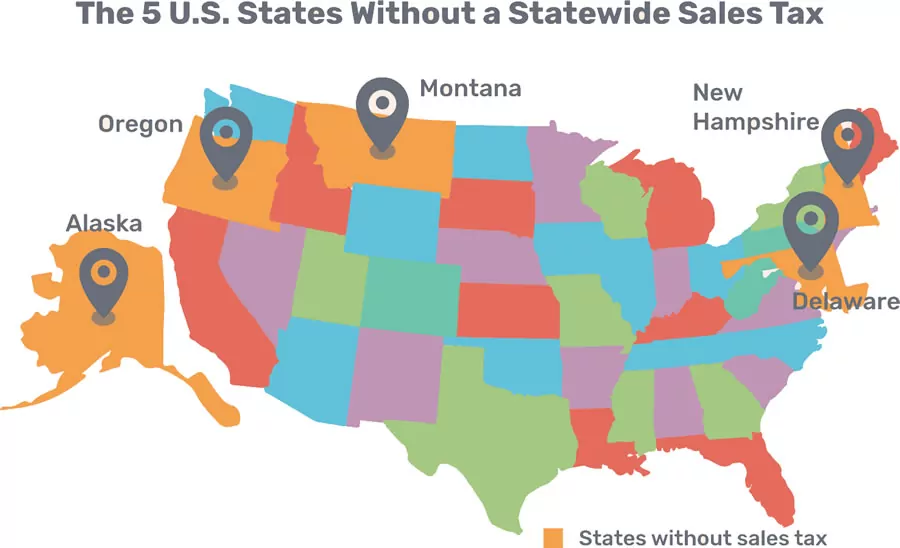

These taxes include telecommunications tobacco tourism cannabis and health care facilities among others. Montana is one of only five states without a general sales tax. 2020 rates included for use while preparing your income tax deduction.

State. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. There is 0 additional tax districts that applies to some areas geographically within Shepherd.

Tax rates last updated in July 2022. Sales tax region name. The Shepherd sales tax rate is NA.

Tax rate of 5 on taxable income between 12001 and 15400. Taxing Jurisdiction Rate. The Missoula sales tax rate is.

State State Tax Rate Rank Avg. 2022 Montana state sales tax. Detailed Montana state income tax rates and brackets are available on this page.

The Montana sales tax rate is currently. HELP Entity Fee HEF HELP Integrity Fee HIF Hospital Facility Utilization Fee HUF Intermediate Care Facility Utilization Fee ICFUF Local Resort Tax. B Three states levy mandatory statewide local add-on sales taxes at the state level.

As of July 1 2020. Public Service Regulation Fee PSR. Other Tobacco Product Taxes.

The December 2020 total local sales tax rate was also 0000. Tax rate of 6 on taxable income between 15401 and 19800. The Saltese sales tax rate is NA.

2022 Montana Sales Tax Table. The current total local sales tax rate in Missoula MT is 0000. Local Tax Rate Combined Rate Rank Max Local Tax Rate.

These rates are weighted by population to compute an average local tax rate. For married taxpayers living and working in the state of Montana. In effect that lowers the top capital gains tax rate in Montana from 69 to 49.

State Local Sales Tax Rates As of January 1 2020 a City county and municipal rates vary. The Montana income tax has seven tax brackets with a maximum marginal income tax of 690 as of 2022. This is the total of state county and city sales tax rates.

Tax rates last updated in August 2022. In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7.

Montana State Taxes Tax Types In Montana Income Property Corporate

States Without Sales Tax Article

Montana Income Tax Information What You Need To Know On Mt Taxes

State Corporate Income Tax Rates And Brackets Tax Foundation

Montana State Taxes Tax Types In Montana Income Property Corporate

Historical Montana Tax Policy Information Ballotpedia

Montana State Taxes Tax Types In Montana Income Property Corporate

How To Import A Motorcycle From The Usa To Canada Youmotorcycle

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

Montana Property Taxes Keep Rising But Missoula Isn T At The Top

Montana Property Taxes Montana Property Tax Example Calculations

How Do State And Local Sales Taxes Work Tax Policy Center

States Without Sales Tax Article

U S Sales Taxes By State 2020 U S Tax Vatglobal

U S States With No Sales Tax Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation